colorado estate tax threshold

Types of Estate Administration. The estate tax is a tax on an individuals right to transfer property upon your death.

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

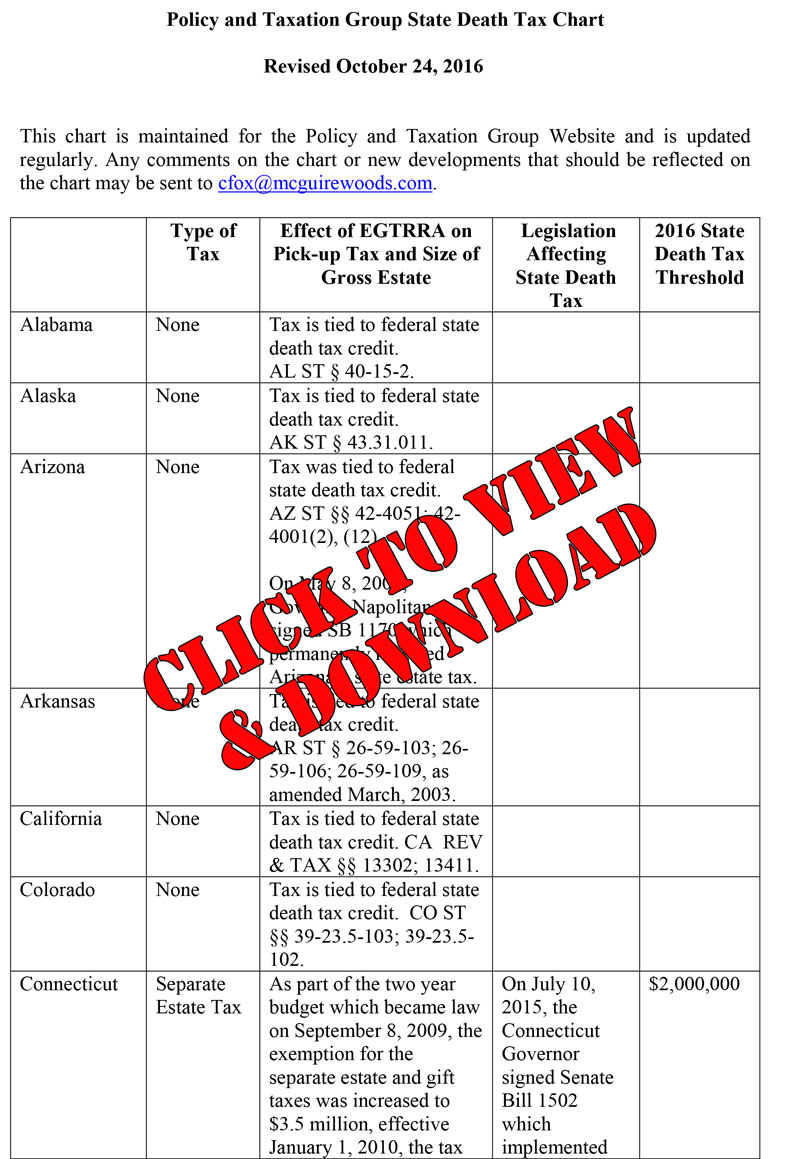

No estate tax or inheritance tax Connecticut.

. So for instance if an estate is valued at 400000 40 percent. Until 2005 a tax credit was allowed for federal estate. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

They would apply to the tax return filed in. Restaurants In Matthews Nc That Deliver. Colorado Estate Tax Threshold.

In 2022 Connecticut estate taxes will range from 116 to 12. For tax years 2022 and later the Colorado income tax rate is set at 455. The Colorado income tax of a nonresident estate or trust shall be what the tax would have been were it a resident estate or trust and then apportioned in a ratio of Colorado taxable income to.

Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. Colorado Estate Tax Threshold.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. All retail sales are considered for the purpose of the 100000 threshold regardless of. In November 2021 the IRS announced the revised federal estate tax and gift tax limits for 2022.

Federal Estate Tax Exemptions For 2022. A state inheritance tax was enacted in Colorado in 1927. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold.

22 hours agoWhere IHT is due it will be levied at 40 percent on the parts of the estate valued over the 325000 threshold. In 2022 the federal estate tax ranges from rates of. Devisees or heirs may.

From Fisher Investments 40 years managing money and helping thousands of families. Individuals can exempt up to 117 million. A state inheritance tax was enacted in Colorado in 1927.

From Fisher Investments 40 years managing money and helping thousands of families. The exemption amount will rise to. Until 2005 a tax credit was allowed for federal estate.

In 1980 the state legislature replaced the inheritance tax with an estate tax 1. Small estate While a small estate offers the simplest and cheapest form of probate only estates worth less than 50000 can claim this. There is no federal inheritance tax but there is a federal estate tax.

The estate tax sometimes also called the death tax is a tax thats levied on the transfer of a deceased persons assets. Opry Mills Breakfast Restaurants. In 1980 the state legislature replaced the inheritance tax 1 with an estate tax.

In other words when an estate is passed on the federal government taxes the transfer. The 2022 state personal income tax brackets. The federal estate tax limit will rise from.

Before the official 2022 Colorado income tax rates are released provisional 2022 tax rates are based on Colorados 2021 income tax brackets. Whose tax payments may increase. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021.

In 2022 an individual can leave 1206 million to their heirs without paying any federal estate or gift tax. The estate tax is a tax applied on the transfer of a deceased persons assets. Do you make more than 400000 per year.

See here for the sites reposting policy. Married couples can avoid taxes as long as the estate is valued at. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate.

One of the new laws HB-1311 will eliminate certain state tax deductions for individuals and. Married couples can exempt up to 234. However under certain circumstances involving fiscal year state revenues in excess of limitations established.

The following are the federal estate tax exemptions for 2022. Connecticuts estate tax will have a flat rate of 12. Small estates under 50000 and no real property.

The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. Below are the tax rates and income brackets that would apply to estates and trusts that were opened for deaths that occurred in 2021. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

However if the decedent owned. And to find the amount due the fair market values of all the decedents assets as of death are.

Estate Tax Rates Forms For 2022 State By State Table

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Is Tax Liability Calculated Common Tax Questions Answered

Colorado Estate Tax Everything You Need To Know Smartasset

State Death Tax Family Enterprise Usa

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Are Your Clients Subject To Massive Estate Taxes Without Knowing It Everplans

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Estate And Inheritance Taxes Itep

Colorado Estate Tax Everything You Need To Know Smartasset

Colorado Estate Tax Do I Need To Worry Brestel Bucar

State Corporate Income Tax Rates And Brackets Tax Foundation

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

2020 Estate Planning Update Helsell Fetterman

Colorado Estate Tax Everything You Need To Know Smartasset

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation